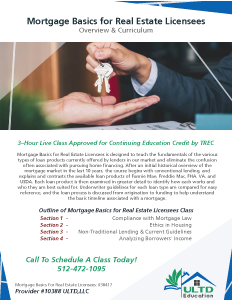

Mortgage Basics for Real Estate Licensees

- Elective CE – 3 Hours – TREC Approval Number #35259-RECE

Mortgage Basics for Real Estate Licensees is designed to teach the fundamentals of the various types of loan products currently offered by lenders in our market and eliminate the confusion often associated with pursuing home financing. After an initial historical overview of the mortgage market in the last 10 years, the course begins with conventional lending, and explains and contrasts the available loan products of Fannie Mae, Freddie Mac, FHA, VA, and USDA. Each loan product is then examined in greater detail to identify how each works and who they are best suited for. Underwriter guidelines for each loan type are compared for easy reference, and the loan process is discussed from origination to funding to help understand the basic timeline associated with a mortgage

Outline of Mortgage Basics for Real Estate Licensees Class

- Section 1 – Compliance with Mortgage Law

- Section 2 – Ethics in Housing

- Section 3 – Non-Traditional Lending & Current Guidelines

- Section 4 – Analyzing Borrowers’ Income